As Apple Preps to Unveil AI Products, How Should You Play AAPL Stock?

/Apple%20Inc%20Tim%20Cook-by%20John%20Gress%20Media%20Inc%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is now at the heart of growth in technology, with the global AI market expected to reach around $244 billion in 2025. The biggest tech names are racing to bring smarter, more adaptive AI into every device and service on the market. Over the past month, Apple (AAPL) shares have risen by 11.58%, lifted by strong third-quarter results and growing interest in its “Apple Intelligence” features for iPhones, Macs, and iPads.

Even so, while the company is benefiting from AI investment and steady demand, the stock is still down 11% from its 52-week highs and has lagged behind other major tech stocks and sector benchmarks.

Ongoing concerns around tariffs and changes to supply routes have also put some pressure on investor sentiment. CEO Tim Cook remains upbeat, signaling that new AI products are in the pipeline and hinting at big moves ahead with possible acquisitions to strengthen Apple’s AI offering.

Attention now turns to Apple’s upcoming launch of new AI-powered devices and software, a moment that could shape where the company stands in the tech world. With these new ambitions coming into focus, is this the turning point for AAPL stock to regain momentum, or does caution remain the smarter move? Let's take a look.

How AAPL’s Financials Are Shaping Up

Apple’s approach centers on bringing together new hardware, easy-to-use software, and a services network that consistently keeps customers coming back. This strategy builds steady demand for main products like the iPhone and iPad, while also supporting a growing services business.

Over the last 52 weeks, shares managed a small gain of just under 2.5%, but have slipped almost 8% so far this year.

The company’s valuation is still ahead of the sector, with a forward price-to-earnings (P/E) ratio of 31.3x, compared to the sector’s average of 23.7x. Investors continue to trust Apple’s proven record of growth and reliability, shown in its 14 years of increasing dividends, most recently paying $0.26 per share, with a low payout ratio of 13.81%, which leaves plenty of space for future increases.

Apple’s recent quarter highlights strong fundamentals, with revenue rising 10% year-over-year (YOY) to $94 billion, and diluted EPS up 12% to $1.57. Net income stood at $23.43 billion, while gross margin for the quarter was $43.72 billion, and operating income came in at $28.20 billion. iPhone revenue jumped to $44.58 billion, with Mac at $8.05 billion, iPad at $6.58 billion, and Services reaching a new all-time record at $27.42 billion.

The company saw double-digit growth across both iPhone and Mac segments and marked an all-time high for its installed device base across every category and region. Growth was global, with revenue increasing in the Americas, Europe, Greater China, Japan, and the Rest of Asia Pacific. Apple ended the period with $36.27 billion in cash and equivalents, while also returning $70.58 billion to shareholders through share buybacks over the past nine months.

Apple’s Strategic Levers

GlobalFoundries (GFS) and Apple have expanded their work together to push U.S. semiconductor tech forward. This step opens the door to state-of-the-art chipmaking and speeds up AI hardware built for the next generation of mobile computing and smart devices, matching the push for tech sovereignty and the market’s focus on a dependable supply chain. It also helps Apple develop power‑efficient, AI‑focused chips in the U.S., signaling tighter control over critical silicon, better supply assurance, and a path to optimize cost and performance for AI features rolling across iPhone, iPad, and beyond.

Apple’s $100 billion commitment aimed at bringing more of the supply chain onshore through the American Manufacturing Program backs that effort with real money. This is not purely patriotic optics; domestic capacity can reduce geopolitical and logistics risk, speed iteration cycles for AI hardware, and position Apple to influence standards in emerging edge‑AI categories. A larger U.S. manufacturing footprint can also unlock policy tailwinds and incentives, supporting capital intensity without diluting returns.

The extended deal with Coherent (COHR) adds another link, securing advanced photonics from Texas, including the vertical‑cavity surface‑emitting lasers that power Face ID. Locking in this supply strengthens control over features that distinguish Apple’s devices, which matters as smart capabilities become central to how products compete.

Expectations and the Road Ahead

Street estimates point to EPS of $1.73 for the September 2025 quarter, and $7.33 for FY2025, which lines up with year-over-year growth of 8.59%. That backdrop helps explain why UBS, Citigroup, Bank of America, Barclays, and Morgan Stanley raised targets, leaning into improving revenue trends and the growing AI push ahead of the product reveal. The debate isn’t one-sided.

Needham cut the stock from “Buy” to “Hold” in June, citing slower innovation versus AI peers, softer device replacement cycles, and regulatory overhang. Analyst Laura Martin also noted that March‑quarter revenue and margin growth lagged Google (GOOG) (GOOGL) and Amazon (AMZN), raising fair questions about whether new AI features and upcoming hardware can truly spark a broad upgrade.

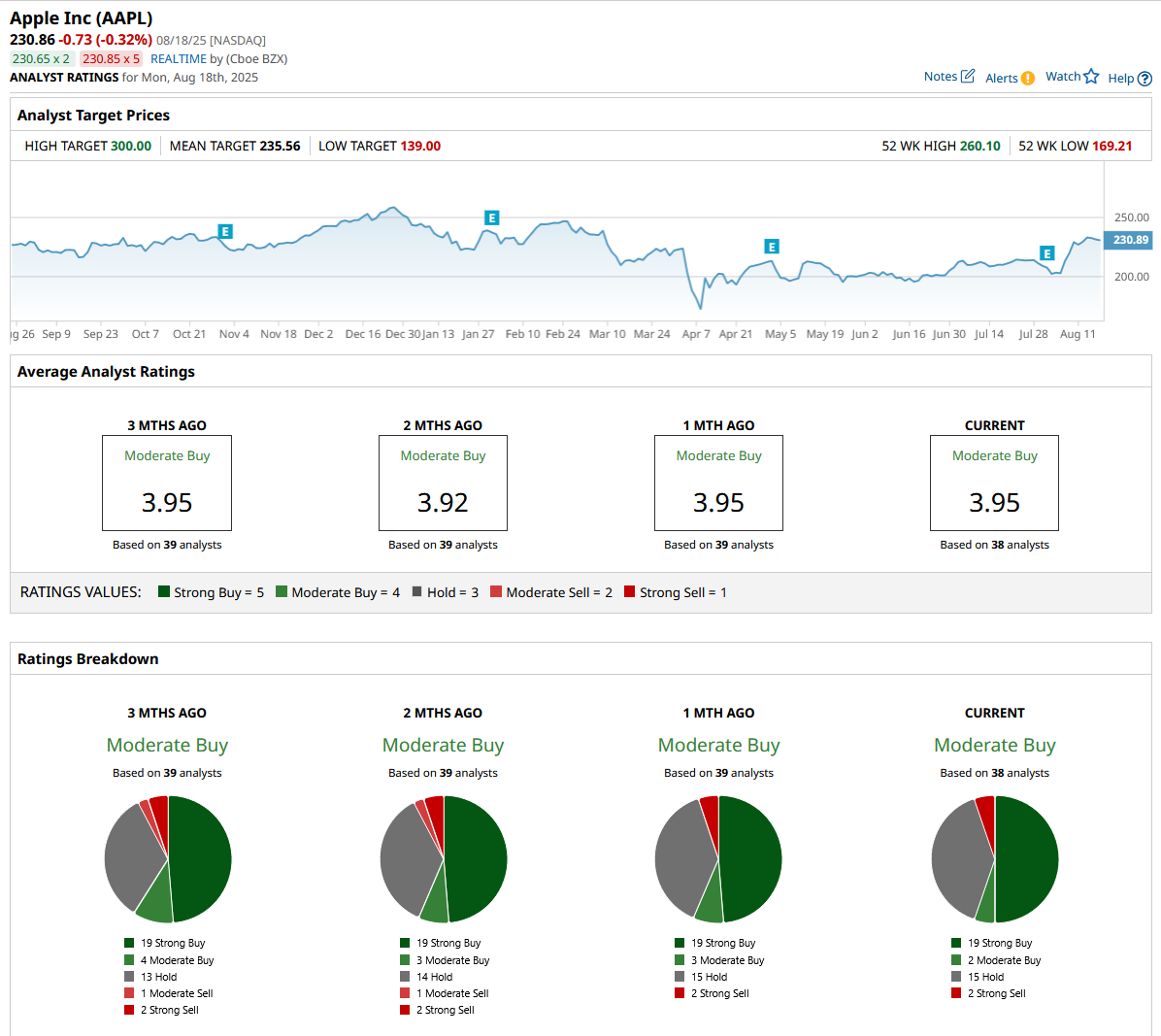

Even with those concerns, the overall stance remains constructive. Across 38 analysts, the consensus rating sits at “Moderate Buy,” with a mean target of $235.56, about 2% above the current $230.86.

Apple enters this pivotal stretch with high expectations and strong fundamentals that suggest both resilience and potential for growth. While the market is weighing strong execution against cautious upgrade cycles, the foundations look solid, long-term supply partnerships, robust cash flow, and a proven model for monetizing innovation. With new AI-enhanced products on deck and analysts broadly constructive, the case for keeping AAPL in the mix remains strong, especially for those with an eye on both growth and quality as the next chapter unfolds.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.