Should You Buy the Dip in Kroger Stock?

The Kroger Company (KR) is one of America’s leading retail giants, specializing in multi-departmental stores and supermarkets. Kroger offers an extensive selection of products, ranging from fresh foods and organic groceries to general merchandise, complemented by exclusive private label brands, including Simple Truth. The company is known for its dedication to convenience, value, and continuous innovation, offering seamless e-commerce and digital shopping experiences for its customers.

Founded in 1883, it operates more than 2,700 stores in 35 states with its headquarters in Cincinnati, Ohio.

Kroger’s Stock Movement

KR stock has delivered impressive returns despite a volatile 2025, rising 14% year-to-date and outperforming the S&P 500’s ($SPX) 9.65% gain. Over the past year, Kroger shares have surged 32% more than doubling the index’s performance. At present, KR stock is 7% below its 52-week high set last week, presenting an entry point for investors.

Kroger’s Solid Q1 Report

Kroger posted its first-quarter 2025 results on June 30, outperforming analyst estimates. Adjusted earnings per share reached $1.49, exceeding the previous year’s $1.43 and topping expected levels. Operating profit for Q1 totaled $1.32 billion, up from $1.29 billion year-over-year (YOY). Revenue for the quarter came to $45.12 billion, falling short of analysts’ $45.38 billion. Excluding fuel and specialty pharmacy sales, revenue increased by 3.7% over last year, showing resilient underlying growth despite a total reported sales decline due to strategic divestments.

Other key financial indicators highlight Kroger’s operational strength. The FIFO operating profit, excluding adjustment items, rose to $1.52 billion, and gross margin improved to 23% from 22% posted last same quarter last year and was supported by lower supply chain costs and reduced shrinkage. Kroger’s balance sheet remains stable, with net total debt to adjusted EBITDA at 1.69, well below its targeted range.

Looking ahead, Kroger raised its identical sales guidance for 2025 to a range of 2.25% to 3.25%, reflecting ongoing customer engagement and momentum in fresh, private label, and e-commerce segments. The company remains committed to boosting shareholder value through continued dividend payments and an accelerated $7.5billion share repurchase program, with confidence in long-term sustainable growth and strategic investment.

Kroger had also announced a 9% increase to its quarterly dividend to $1.40 per share from $1.28 per share. Aug. 15 had been set as the record date.

Amazon Fresh Threatens Kroger

KR stock dropped 3% last Wednesday following Amazon’s (AMZN) major expansion of its Amazon Fresh grocery delivery service across over 1,000 U.S. cities, aiming to reach 2,300 locations by year-end 2025. Amazon Fresh will now be offering Same-Day Delivery on perishable items such as produce, meat, dairy, and frozen goods, which will be integrated into its fast and efficient logistics network with free delivery for Prime members on orders over $25.

This aggressive move intensifies competition in the grocery delivery market, posing a significant challenge to traditional supermarket chains like Kroger. As Amazon’s service gains popularity among Prime members, Kroger faces increasing pressure to accelerate its digital and delivery innovations to maintain market share.

Analyst Take on Kroger

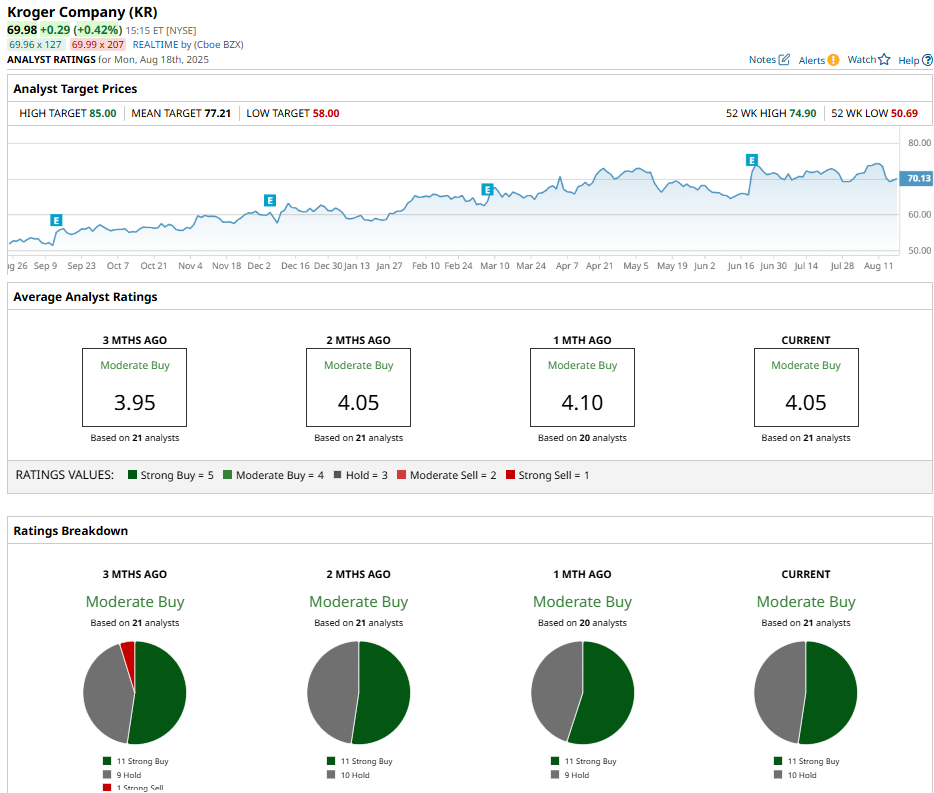

Analysts have some mixed responses on the retail giant, with a consensus “Moderate Buy” rating and a mean price target of $77.21, reflecting an upside potential of 10% from the market price.

Kroger has been reviewed by 21 analysts while receiving 11 “Strong Buy” ratings and 10 “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.